The Florida medical malpractice insurance market continues to stand out in 2025. While many states are dealing with a hard market and steep premium increases, Florida physicians are still experiencing relative stability. Moderate rate filings, strong carrier participation, and lower statutory liability limits help keep premiums more affordable compared to other regions.

However, Medical malpractice insurance in Florida is not entirely shielded from national pressures. Rising claim severity, record-breaking jury awards, and insurer consolidation are shaping the market and may create upward pressure on rates in the coming years.

Hard Market Pressures vs. Florida Stability

- Across the United States, nearly half of all medical malpractice premiums are rising again in 2025.

- Many states are seeing double-digit increases, showing that the industry has entered a hard market cycle.

- In comparison, Florida’s average rate filings in 2025 remain relatively modest, giving physicians some relief.

Florida’s stability is supported by several factors: strong competition among carriers, statutory lower liability limits, and a regulatory environment that continues to encourage insurer participation.

![]()

Key Market Drivers in Florida

Claim Severity and Rising Costs

In 2025, insurers continue to report higher claim severity with larger settlements and increased defense costs. While Florida physicians have not yet faced extreme premium hikes, claim severity remains a key risk factor that could influence future filings.

Nuclear Verdicts Continue in 2025

Florida courts are still delivering nuclear verdicts, defined as jury awards exceeding 10 million dollars. Several such verdicts have already been recorded in 2025. These cases have a direct impact on insurer pricing and carry the greatest consequences for high-risk specialties such as obstetrics, neurosurgery, and general surgery.

Insurer Competition and Consolidation

- New entrants and risk retention groups are still being approved in 2025, creating more choice for physicians and keeping competitive pressure in the market.

- A major development this year is the Doctors Company’s announced acquisition of ProAssurance for 1.3 billion dollars, scheduled to close in 2026. This merger may strengthen financial stability but could also reduce competition in certain parts of Florida.

Legislative and Regulatory Updates

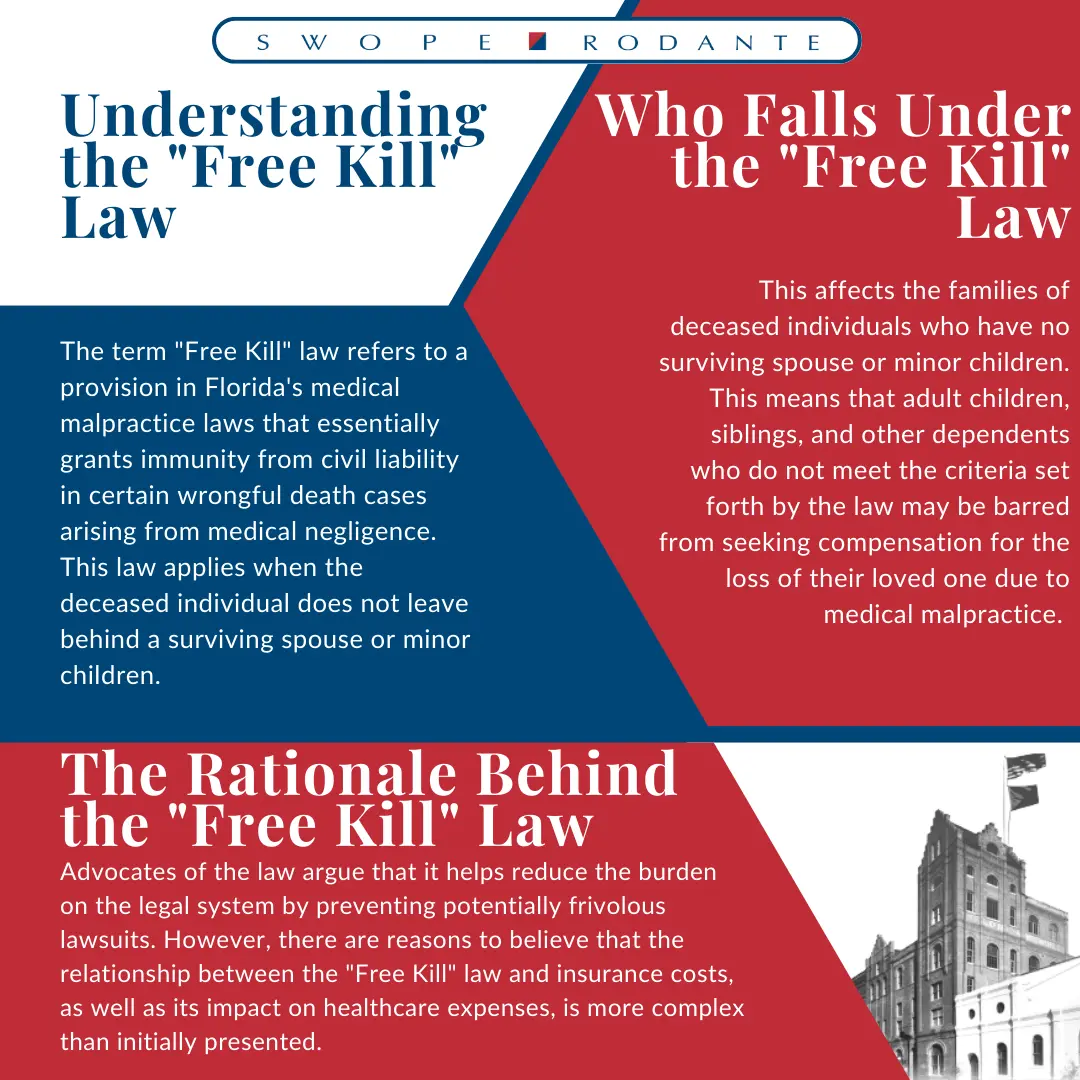

- Florida’s controversial Free Kill law remains in effect. In 2025, lawmakers once again advanced a repeal, but Governor DeSantis vetoed the bill. As a result, restrictions on who can pursue non-economic damages in wrongful-death medical malpractice cases remain unchanged.

- Proposals to introduce caps on non-economic damages, ranging from 500,000 to 750,000 dollars, were debated in 2025 but have not been enacted. Insurers continue to factor these possible changes into long-term planning.

Coverage Limits in Florida

Florida physicians continue to benefit from lower statutory coverage limits compared to most states.

- Standard policy: 250,000 dollars per claim and 750,000 dollars aggregate

- In many other states, minimum requirements are 1,000,000 dollars per claim and 3,000,000 dollars aggregate

These lower limits are one of the main reasons why premiums in Florida remain more affordable. Doctors who require higher protection can purchase greater limits or umbrella coverage, but the majority still rely on the statutory minimums.

![]()

Discounts That Help Physicians Save

Florida’s competitive malpractice insurance market in 2025 continues to offer physicians multiple opportunities to save. Common discounts include:

- Claims-free discounts for physicians with no prior losses

- Risk management credits for completing approved training

- Board certification discounts across most specialties

- Group practice discounts for doctors who insure together

- Part-time physicians can receive discounts, which can reduce premiums by 50 percent or more for those working fewer than 20 hours per week

By combining these credits with competitive shopping, physicians across Florida continue to reduce premiums significantly.

What Physicians Should Do in 2025

Although Florida remains more stable than most states, physicians should stay proactive.

- Shop multiple carriers to take advantage of new entrants and risk retention groups.

- Review coverage limits regularly and consider whether the minimum 250,000/750,000 policy is enough, given the continued rise in large verdicts.

- Maximize available discounts by maintaining a clean record and completing risk management programs.

- Plan for tail coverage, especially as consolidation reshapes the insurance landscape.

- Stay informed about legislative debates that could change malpractice exposure in the future.

Before you make any career or location changes, it’s worth understanding how relocating can affect your coverage and costs. If you’re planning a move, check out our guide on moving to Florida: things every physician should know. It covers licensing, insurance considerations, and practical tips for physicians transitioning to Florida.

Stability with Caution Ahead

In 2025, Florida physicians will remain in a stronger position than their peers in other states. However, claim severity, nuclear verdicts, legislative uncertainty, and insurer consolidation could change the outlook in the coming years. The market remains favorable today, but physicians should take steps now to prepare for potential cost increases.

Partnering with PLI Consultants

At PLI Consultants, we specialize in helping Florida physicians navigate the 2025 malpractice insurance market. We track insurer filings, monitor legislative developments, and identify competitive programs that deliver both cost savings and reliable protection.

Whether you prefer the minimum statutory limits of 250,000/750,000 or need higher coverage, we provide multiple quotes from A-rated carriers to ensure the right fit.

Contact PLI Consultants today for a no-obligation quote and see how much you can save on your Florida medical malpractice insurance in 2025.