Medical malpractice insurance is a form of professional liability insurance that protects healthcare providers from the financial risks of malpractice claims. It safeguards physicians, surgeons, nurses, and other licensed professionals when a patient alleges injury or harm resulting from negligence or treatment errors. This coverage also helps manage the high cost of defending lawsuits, which can reach tens or even hundreds of thousands of dollars.

Most physicians will face a malpractice claim at some point in their career, making the right malpractice insurance policy critical for protecting both professional practice and personal assets.

![]()

The Two Main Types of Policies

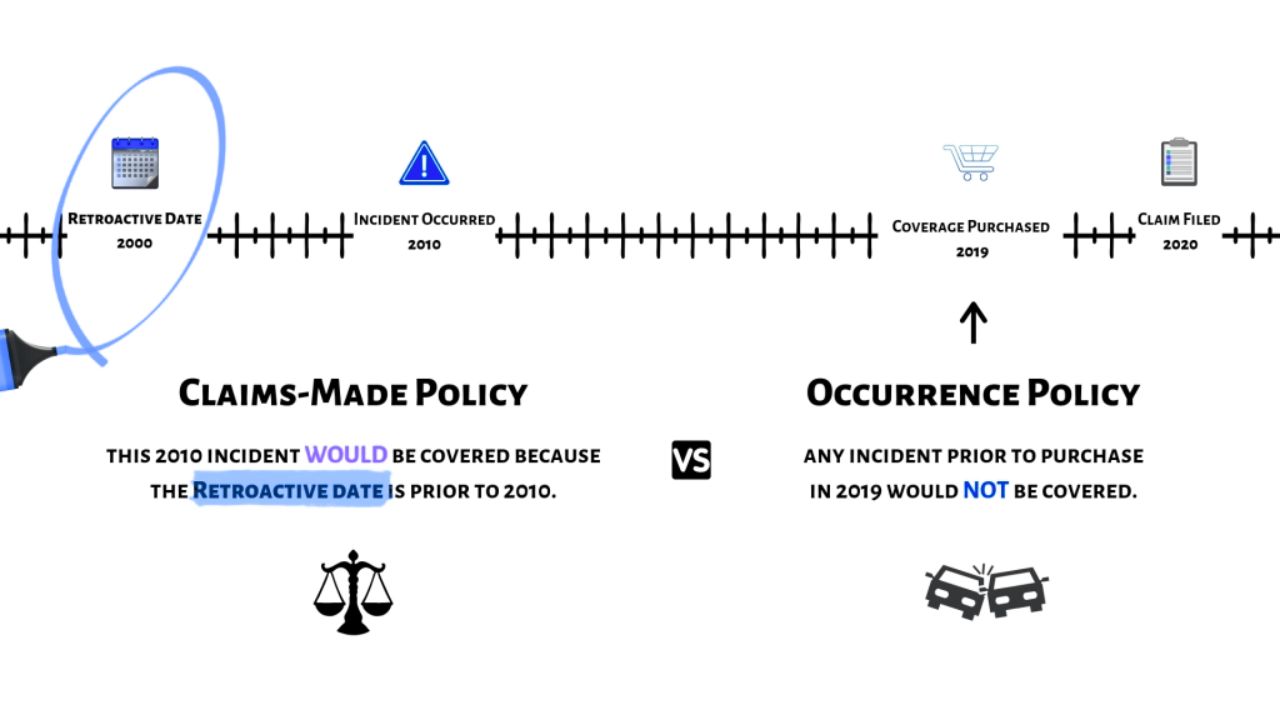

There are two primary types of medical malpractice insurance policies: occurrence and claims-made. Understanding how each policy type works is essential for long-term protection and financial planning.

Claims-Made Policies

Claims-made policies cover malpractice claims only if both the incident and the claim occur while the policy is active. These policies are based on the date the claim is reported, not the date the treatment occurred.

A claims-made policy usually includes a retroactive date, which marks the beginning of coverage. Each time you renew, that retroactive date stays the same. If the policy is canceled or lapses, any future claims for past incidents won’t be covered unless you purchase tail coverage.

These policies tend to be more affordable in the first few years. The premium increases gradually through a process called step-rating and eventually reaches a mature rate. Claims-made policies are appealing to new healthcare providers because of the lower initial cost.

However, you’ll need to manage coverage actively, especially during job changes or retirement.

Occurrence Policies

Occurrence policies cover incidents that occur during the policy’s active period, regardless of when the claim is filed. If an incident occurs during your coverage period, even if the lawsuit is filed years later, you’re still protected.

For instance, a surgeon covered by an occurrence policy in 2024 is still protected if a patient files a claim in 2026 for a 2024 procedure. The policy is tied to the date of the incident, not the date the claim is reported.

This kind of coverage does not require additional protection, like tail coverage, when the policy ends. It offers long-term peace of mind, especially for complications or injuries that surface years after treatment.

However, occurrence policies often come with higher upfront premiums since the insurer assumes the risk of future claims indefinitely. While less common today, they are still available and offer straightforward protection.

Tail Coverage

Tail coverage, or an Extended Reporting Period (ERP), allows you to report claims for incidents that occurred while your claims-made policy was active, even after the policy ends. It does not cover new incidents, only those that happened before policy termination.

Tail coverage is essential if you’re retiring, switching jobs, or letting your policy lapse. It prevents gaps in protection and ensures you’re still covered for past care.

Tail coverage can be expensive, often costing between 150% and 200% of your last annual premium. Some insurers offer it for free under certain conditions, such as permanent retirement, disability, or death. In some cases, a new employer may cover the tail costs as part of your contract.

Alternatively, some providers secure prior acts coverage, or “nose coverage,” from a new insurer. This allows the new policy to cover incidents from the previous policy period, eliminating the need for tail coverage.

Key Differences: Claims-Made vs Occurrence

- Coverage Trigger: Occurrence is based on when the incident happened. Claims-made is based on when the claim is reported.

- Tail Coverage: Required for claims-made policies when coverage ends. Not required for occurrence policies.

- Premium Structure: Occurrence costs more upfront but includes long-term protection. Claims-made starts cheaper and increases over time.

- Simplicity: Occurrence is easier to manage. Claims-made requires careful planning to avoid coverage gaps.

- Availability: Claims-made policies are more commonly offered. Occurrence is less available, especially for high-risk specialties.

Choosing the Right Policy

The right policy depends on your specialty, career plans, and risk tolerance. Occurrence policies offer simplicity and long-term security, making them ideal for providers who want predictable coverage without the hassle of managing tail extensions. Claims-made policies are often more budget-friendly early in your career and offer flexibility, but require active oversight.

If you plan to switch jobs or retire, consider how your policy choice affects your need for tail coverage. Always review employment contracts to determine who is responsible for post-employment protection.

For a deeper foundation on how malpractice coverage works, you can explore our guide on

Medical Malpractice Insurance 101, which explains the core principles every physician should understand.

Expert Guidance Makes a Difference

Medical malpractice insurance is your safety net against one of the biggest financial risks in healthcare. The right policy gives you confidence and lets you focus on patient care.

At PLI Consultants, we help healthcare providers evaluate their options and choose the right malpractice coverage for their needs. Whether you’re comparing claims-made vs occurrence or planning your tail coverage, we’re here to help.

Ready to secure your peace of mind? Contact PLI Consultants today for personalized malpractice insurance guidance.